So initial loan payments are heavily weighted to interest, and payments toward the end of the loan are heavily weighted to principal. Was 2.59%, which was higher than the 2.44% yield on 30-year Treasury bondsĪn amortizing loan payment is one that repays a loan’s principal balance over the term of the loan. (As of April 1, the yield on 20-year U.S. One reason for this is that no average is available for a 40-year home-purchase or refinance market that doesn’t really exist yet.Īnother reason is that a 40-year loan wouldn’t necessarily have a higher rate than a 30-year loan. The loan payments also exclude property taxes and insurance premiums, which are typically escrowed and collected by the loan servicer as part of the total monthly payment.įor the 40-year loan, we’re using the same interest rate as a 30-year loan. The following payment examples don’t reflect origination fees or points, or other fees for various services during the loan-origination process.

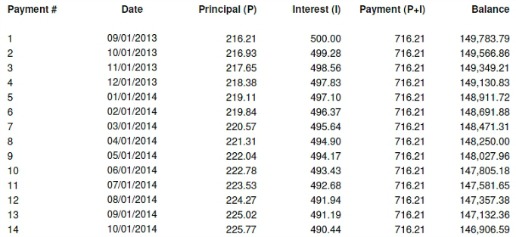

home-sale prices since 1970:Īccording to Freddie’s survey for the week ended March 31, 2022, the average interest rate for a 30-year loan was 4.67% and the average for a 15-year loan was 3.83%. Louis, showing the movement of median U.S. Before we make loan-term comparisons, here’s a chart from the Federal Reserve Bank of St. The obvious potential advantage of a 40-year loan is a lower monthly payment. Both have already participated in programs to modify existing mortgage loans to 40-year terms for struggling borrowers, and both would be involved if 40-year loans became widely available for home buyers. The two mortgage giants, both of which were taken under government conservatorship in 2008, set the credit underwriting standards for the loans they buy. Which buy the great majority of new loans, package them up and sell mortgage-backed securities to investors. has an incredibly liquid mortgage loan market, led by Fannie Mae Read: Really, a 40-year mortgage? One Fed official thinks it’s a good idea. But this could point the way to wide acceptance and availability of 40-year loans for all home buyers. Jacob Passy explained that discussions among government agencies of 40-year mortgage loans have so far centered around loan modifications for struggling borrowers to bring their payments current. Below is an example of what loan payments might look like for a 40-year fixed-rate mortgage loan, compared with typical 30-year and 15-year loans.

0 kommentar(er)

0 kommentar(er)